Fuel Prices and Inflation

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape Program

Last Modified: March 13, 2013

The greatest challenge on farmers is inflation, as grape prices; along with other food prices do not follow any measure of inflation. Farmers and growers alike have to continue to innovate and scale their operation to keep up with inflation. As such, lower levels of inflation, no matter their cause, is often good news for the farmer. There is a common misconception that rising energy costs or fuel costs lead to inflation.

Economic inflation is dependent on the money supply. The access consumers have to money is related to both the supply of currency and credit as well as the value of the dollar relative to other currencies. Observing these indicators is a predictor for inflation.

The Federal Reserve has actively been pushing consumers out their doors and into stores. Target interest rates have been at 0% - .25% for just over two years. Printed money and other measures of currency continue to increase at higher than historical rates. Tempering these inflationary forces are consumer sentiment and foreign currency values. Consumers have increased their savings rate because of concerns revolving around housing value, stock market performance and job security. Until consumers feel better about their jobs, investments and home values they are just not likely to spend the extra money they now have access to.

Figure 1. Growth in liquid money supply (M1), as measured by the Federal Reserve continues to expand. Think of M1 as cash accounts.

In the last eighteen months, the downward trend in the dollar has nearly reversed course. Some small economies, such as Canada, continue to have a strong and healthy currency as compared to the dollar. However, because of financial and economic stress in Europe the dollar, against the basket of currencies, has regained much of its strength. The value of exports has taken a small step backwards, while imports have become relatively cheaper once again. All of this is in spite of the loose monetary and fiscal policy the US has exercised for nearly six years.M2 Money supply stands at 9,640 Billion, a 10% increase from one year ago. M1 Money supply has increased 18% from one year ago. M1 money supply represents only very liquid money, things like cash and checking accounts. While the dramatic increase in M1 Supply during a recession is impressive, the bulk of dollars and wealth in this economy are captured in the m2 supply data.

This more dramatic increase in M1 supply is a direct result of Federal Reserve economic manipulation. With the target fund rate at 0% - .25%, money supply is the only major tool left in their toolbox. Last year the big news was that Americans were actually saving money. That dramatic shift was the explanation for the infusion of cash, sluggish economic growth, and low rate of inflation.

In reality, the consumer savings rate could not account for such a large amount of cash. 2011 corporate earnings revealed that corporations, not consumers, were stockpiling the cash.

While we will continue to see rising prices on particular goods, the general trend will be slowing inflation and tighter profit margins, especially for production that is energy intensive. For the short term, that is good news, despite the irritation that fuel prices might bring personally. In the longer term Federal Reserve actions should increase the money supply, eventually. M1 supply, the portion of money in liquid accounts has increased dramatically. Eventually if consumer confidence recovers, that money is spent and the savings rate, which is historically high, falls inflation could be a very big factor in your medium term business strategies. Inflation would likely push margins lower as your cost of inputs rose generally, not specifically. At the same time your assets become, potentially less productive, interest rates will rise increasing borrowing costs. To the extent possible, use this period to fix interest rates, and make smart investments. In the future, interest rates may make investments cost prohibitive.

Figure 2. Historical growth in money supply shows that M2 typically drives inflation.

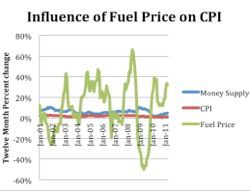

Figure 3. Despite the psychological impact of volatile fuel prices, there is virtually no correlation with inflation.

ReferenceBoard of Governors of the Federal Reserve. Money Stock Measures. Board of Governors of the Federal Reserve System, February 2012. Web. February 7, 2012. http://www.federalreserve.gov/releases/h6/current/

U.S. Bureau of Labor Statistics, Consumer Price Index- December 2011. U.S. Bureau of Labor Statistics, January 2012. Web. February 7, 2012. http://www.bls.gov/news.release/pdf/cpi.pdf

U.S. Bureau of Labor Statistics, Producer Price Index- December 2011. U.S. Bureau of Labor Statistics, January 2012. Web. February 7, 2012. http://www.bls.gov/news.release/pdf/ppi.pdf

Index

Consumer Price Index: Weighted average of prices of a basket of consumer goods and services

Producer Price Index: Weighted index of prices measured at the wholesale, or producer level.

M1: Category of the money supply limited to coins and currency, checking accounts and other similarly liquid accounts

M2: category within the money supply that includes M1 in addition to time-related deposits <100,000, savings deposits, and non-institutional money market funds.

Fuel Prices and Inflation (pdf; 37KB)

Announcements

No Announcements at this time